Why Your Credit Score Controls Your Mortgage Future

Most buyers focus on down payments. Smart buyers know better.

The hidden factor determining your mortgage approval and interest rate isn't just how much cash you bring to closing. Your credit score silently shapes every aspect of your home buying journey, from qualification to final costs.

Understanding this relationship gives you powerful leverage in the mortgage process. Let's explore what lenders actually see when they review your application and how you can position yourself for approval success.

What Lenders Actually See

Your credit score isn't just a number. To mortgage underwriters, it's a risk assessment tool that predicts your likelihood of making payments on time. Most conventional loans require a minimum score of 620, but the best rates typically go to borrowers with scores above 740.

Each 20-point drop in your score can increase your interest rate by 0.25% to 0.5%. This seemingly small difference translates to thousands of dollars over the life of your loan.

For example, on a $300,000 mortgage, a half-percent rate increase could cost you over $30,000 in additional interest over 30 years.

Strategic Score Improvement

Improving your credit score before applying for a mortgage requires deliberate action. Focus on these high-impact areas:

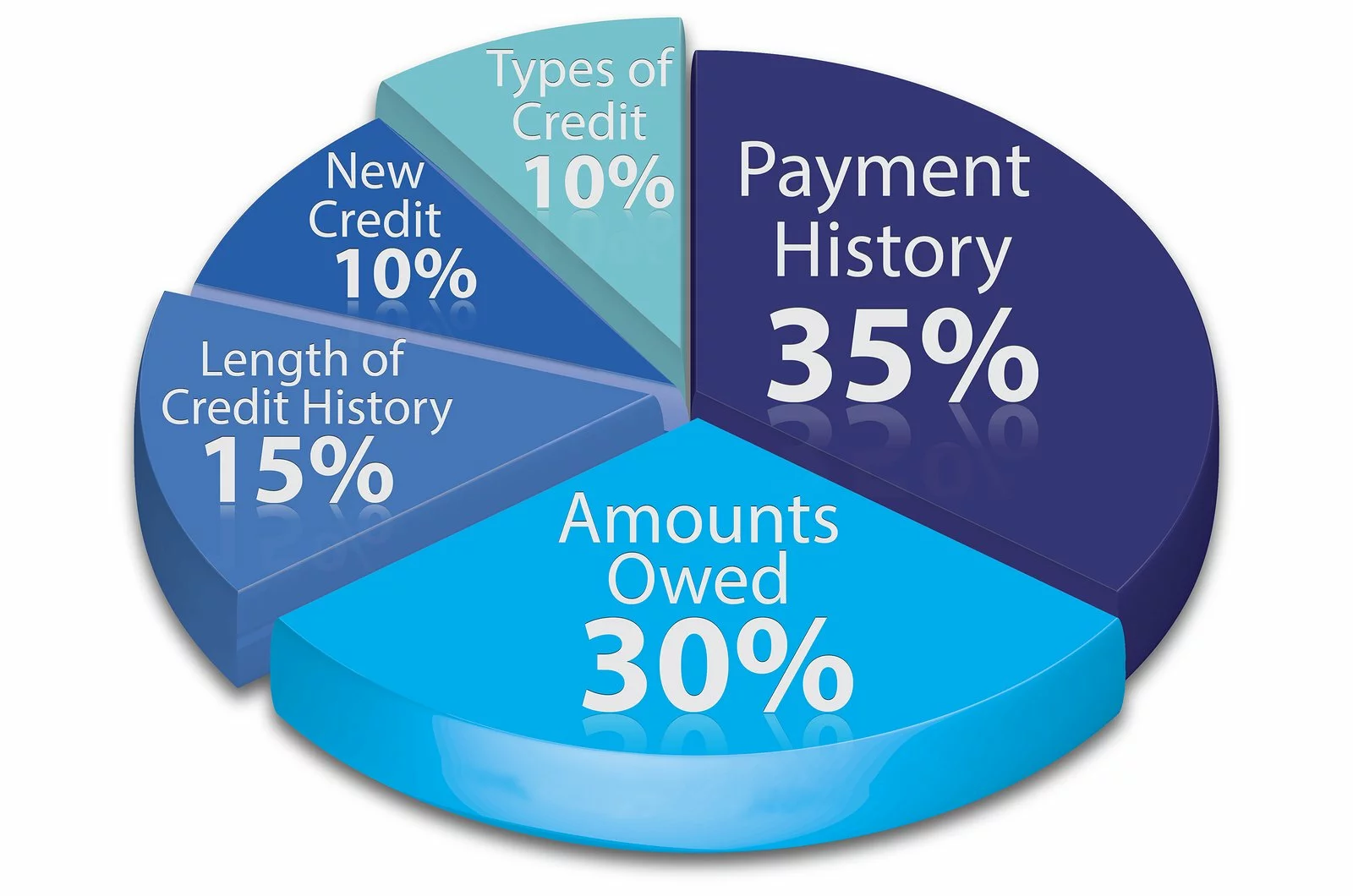

Payment History (35% of score): Establish perfect payment patterns for at least 12 months before applying. Set up automatic payments to ensure consistency.

Credit Utilization (30% of score): Keep credit card balances below 30% of available limits. For maximum score impact, aim for under 10% utilization across all revolving accounts.

Credit Age (15% of score): Maintain your oldest accounts even if unused. The average age of your credit accounts significantly impacts your score.

Credit Mix (10% of score): Demonstrate responsible management of different credit types, including revolving accounts and installment loans.

Recent Inquiries (10% of score): Avoid applying for new credit in the 6-12 months before seeking mortgage approval.

Timeline for Improvement

Credit improvement isn't instant. Plan your mortgage application timeline according to your starting point:

For minor improvements (20-30 points), allow 3-6 months of strategic credit management. For significant improvements (50+ points), prepare for a 6-12 month improvement plan.

The most dramatic score increases come from resolving negative items like collections or late payments, which can take 30-60 days to reflect in your score after resolution.

Beyond the Score

While optimizing your credit score, simultaneously strengthen other aspects of your mortgage application:

Maintain stable employment, reduce debt-to-income ratio below 43% (ideally under 36%), and save for both down payment and reserves.

Request your free annual credit reports from all three bureaus to identify and dispute any inaccuracies. Up to 20% of credit reports contain errors that could affect your score.

The Mortgage-Ready Strategy

Becoming mortgage-ready requires patience and discipline. Start your credit improvement journey at least six months before house hunting. This timeline allows for score improvements to take effect and gives you leverage when negotiating terms.

Remember that mortgage lenders typically use the middle score from all three credit bureaus, so focus on improving your standing across all reporting agencies.

By understanding how your credit score influences mortgage eligibility and taking strategic action to improve it, you position yourself for better rates, more favorable terms, and a smoother path to homeownership.